B2B startup & Enterprise AI Skip India movement, by Vaibhav for Better Capital has been quite a shake out. AI startups shunning Indian clients over free Proof of Concepts & exploitation fears.

Same while AI is biggest unlock of growth for Enterprises. India’s B2B AI market is set to hit $7.8 billion by 2027, growing at 30% annually [NASSCOM]. While, I have clients who expected us to build World’s first of kind product for ₹2 lakh.

All, while Salesforce, SAP are arranging gaga parties in Bandra Kurla Complex, Mumbai with elite CIOs, spending lakhs. They surely see a market worth capturing

I dig deep – on Vaibhav’s wake up call on – “Skip India Moment”. Since it’s a hard problem – VCs or founders who still solve it – of course make the best of unconventional returns. For, aren’t the startups built to solve hardest problems for biggest returns?

Skip India Movement – A frustration called out

Above post has been quite a rage among founders & VCs. Growing eco-system has a great sign when people can call out systemic problems & cause a shake out like above post did. Role of the other eco system players especially founders is to solve it collectively, individually & make it actionable. Hence this post.

Hanlon’s Razor

To get to actionable points, we apply Hanlon’s Razor. In leadership, Hanlon Razor is applied as a way for sound decision making by eliminating unlikely explanations for human behavior.

So, we dive to why Indian customers may appear to ask for Free PoCs. Once done, this sets premises for us to solve

Why likes of Salesforce, nVIDIA, MSFT are spending a lot for Enterprise customers’ engagement.

That should make our GTM clearer. So, startups, founders & VCs who nail this of course have key or at least direction to solving a wicked hard problem.

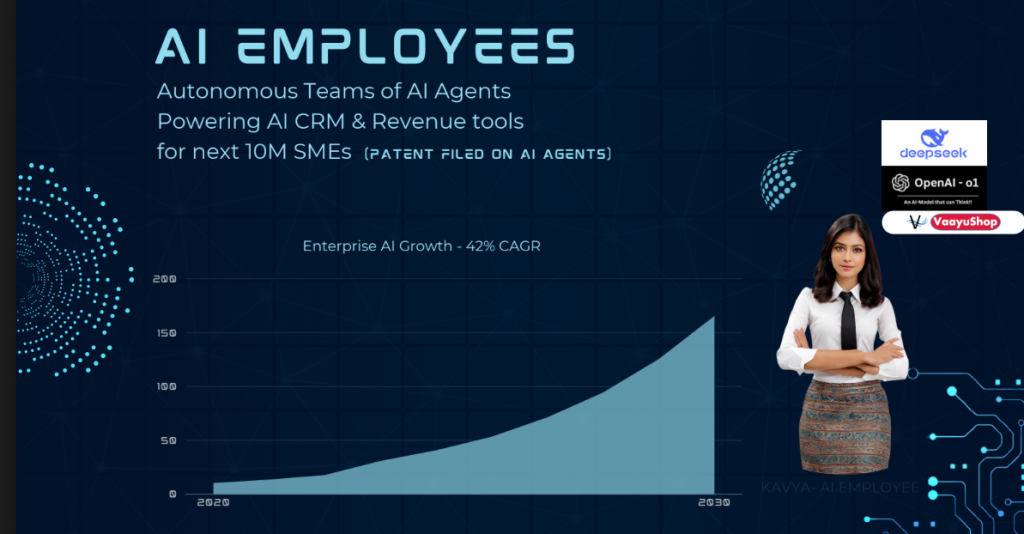

Salesforce Agentforce vs Vaayu vs Skip India Movement

I have spoken to quite a few C-Suite executives for our own product which is like Salesforce Agentforce equivalent for next 10M global SMEs.

Salesforce agentforce is aggressively positioning for Indian market. You speak to CIOs at Banking, Automotive or Real Estate. They will tell you there are gala conferences, freebies, Pilots.

This is reality indicating there is projected market growth. What’s the catch?

I have studied Salesforce strategy, talked to folks in Silicon Valley, Middle East, have investors who understand & have network with Salesforce ecosystem. Why so? Because ourstartup’s own product is similar to Salesforce Agentforce.

Catch India, Go Global movement the Salesforce way

Salesforce reinvests 40% of margins into growth [Salesforce Annual Report, Forbes] & 17% in product. This includes like engaging & educating CIOs about Agentforce including in India.

While Infosys spends 6-8% & less than 1% in R&D. Similarly, Indian VCs, founders & Enterprise platform aren’t yet used to sell products which are ahead of curve & thus need early discounts or higher CAC.

Result – Salesforce makes 74% margins, compounds its monopolistic position & hence future valuations.

So, it’s a rare opportunity for founders, VCs to innovate GTM which can make them high margin, high return. In fact it’s not that new. Even DevRev – a US startup has been spending on engaging CIOs well in advance.

A number game of returns & VCs role

It will be naive to believe Salesforce hasn’t worked out numbers or to believe that they are just throwing money because US has deeper pockets. Absolutely nowhere in the world, businesses throw money. They are bound by potential returns or at the most macro economic conditions unless they are in ZIRP moment.

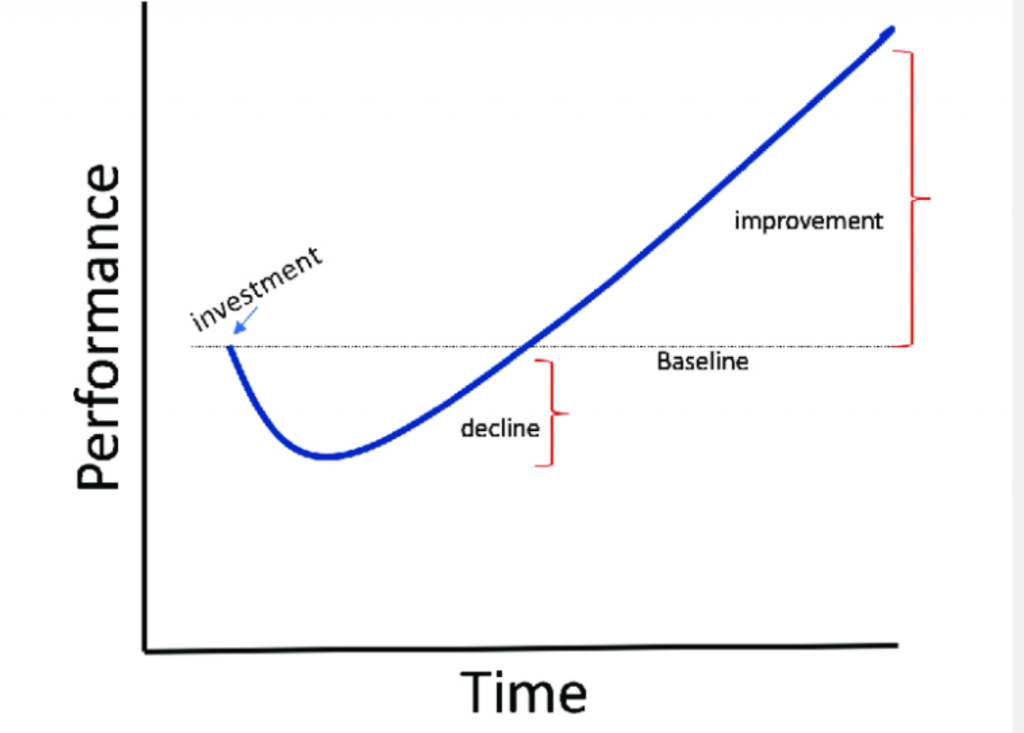

Laxmikant Bhakre, who worked on first bike from Bajaj India & is strategic advisors to boards says “We as a community aren’t early adopters by mindset, so followers waste a lot of time, hence B2B startups face tremendous challenge of high CAC in India”

To onboard a client like Salesforce Agentforce or Vaayu(which is similar) – CAC can go up to Rs 25L. However, just like Salesforce – the LTV, upsell & stickiness is quite high. Which means healthy CAC:LTV ratio.

We have also seen bigger customers in our pipeline aren’t yet used to higher cost that AI demands. They are used to huge scale low pricing realm yet. AI cost reduces in 12-18 months after higher usage. VCs can fund these early adoptions. Uptick for them is monopolistic market, early access & network effect.

But mind you, beyond some reference that some founders are lucky to garner, there’s no escape or shortcut to reap the benefits of revenue without having runway for this CAC.

Unconventional warfare to stop Skip India Movement

A startup can be innovative to engage, educate clients in lower budget. Eg. I am writing this blog for same purpose. I have been able to reach 1000s of people through this. I have always encouraged B2B startups to leverage communities which should be element of change, should spread knowledge without immediate returns.

But the fundamental nuance is same – Either we constructively engage clients, educate them, help them evaluate deep nuances or we wait for others to do it. If you choose latter, we risk competing in crowded market.

I spoke to Vinay Hinge who has worked as CIO of large retail corporates – “In the startup he founded in early 2000s – they were able to use print media to create buzz to ace TCS. Startups should go creative”

But deep nuance remains same.

Cultural shifts which decide fate of Skip India Movement

It’s a great sign when people start calling out – like Vaibhav did before it’s too late for eco-system to improve.

Our client, Mrs Vijaylaxmi Sankar, who deployed AI Kavya & has most progressive AI stack for Sustainability clothing advises SMEs for AI adoption & board advisory. She says, most SMEs don’t have much budget for experimentation. But she has developed a really remarkable lean & precision playbook for deployment of AI agents.

Indian eco-system is not yet accustomed to pay for innovation, thus PoCs. For this inherently means trying out new thing. Consider this – Infosys spends meager Rs 36000 per employee on R&D, experimentations. That’s less than chai-sutta budget of employee.

Enterprises need to think that they get world’s best talent & technology at cost of say Rs. 10-20L of pilot. Something which possibly can put enterprise in different realm. Which otherwise would have costed them crores. Many Enterprise don’t understand ROI which need initial capex investments but can give huge returns.

Though many will be okay as long as they can recover investments in 24 months.

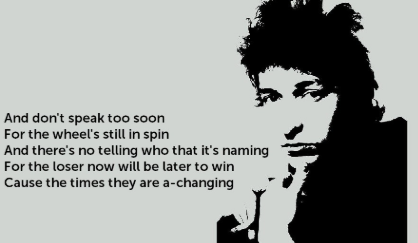

Sign off with Steve Job’s favorite song

In formative years of Jobs, journalists, social systems criticized independent thinking of new rebellious generation. Bob Dylon a rebellious singer said below lines to journalists & experts.

Just like ours generation in India is rebellious to build at global stage. Vaibhav’s post is a sign of this rebellion

Read more – beyond obvious things about AI.

Sail beyond Indus Valley report

Reach out for a talk over coffee/Beer.