Bikhchandani’s 4.7cr investment became 9000cr: Untold secrets altered to AI & Deeptech

In context of exploring the secrets for AI & Deeptech, Sir Sanjeev Bikhchandani’s principals may well be regarded as baseline.

His envious returns will keep any Founder or VC awake at nights. His ₹4.7 crore investment in Zomato that soared to ₹9000 crore in a decade or so. Also, he built Naukri.com, Jeevansathi.com, 99acres.com, and Shiksha.com as early as 90s.

To spot ideas, products, execution & thought process behind Generational outcomes – we decode his 5 secrets. We apply 5 secrets for AI & Deeptech. – We combine his immortal principals with deep ground understanding. Let’s go.

His Secrets for Generational outcomes in AI & Deeptech

He as revealed his core secrets about building info edge, naukari & spotting Zomato early on. He also recently shared his secrets he’s deploying in Deeptech & AI & voice concerns about the commercial viability of deeptech startups, especially within the typical 8–12-year VC timeline, are valid.

Copying the legend isn’t’enough

But we don’t remain limited to that. Generational or 1000x kind of returns don’t come with conventional wisdom or copying others. Even copying our idol – sir Bikhachandani isn’t enough. Rather, it comes with original new ways.

A radical yet practical approach to AI

Applied AI, Applied R&D + Innovative Products + High Agency = Deepseek like moments with constraint = Unconventional returns (Probably)

We challenge the conventional wisdom, refine his take on Deeptech with facts data & rational optimism. We break constraints with our unique insights.

Hence, I share a path forward through applied R&D. By focusing on practical, market-ready AI solutions, we can make deeptech not only viable but transformative, much like China did decades ago. I constructively offer additional-rationale rooted in applied R&D, Product Innovation in frugal budgets and a perspective shaped by resilience, passion, and a touch of “romantic passion.”

Why Generational outcomes with AI & Deeptech?

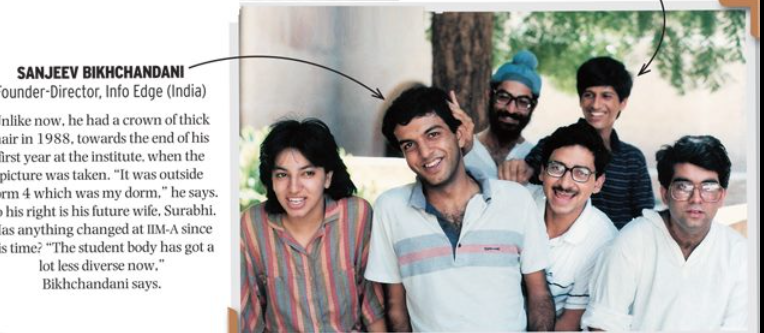

AI presents us the last chance of lifetime

History presents only limited periods where the generational outcomes can be generated. AI is that such moment & probably the last one.

Decision we all must first take

Do we want to go for maximal generational outcome, even with lesser probability? Or we want mediocre outcomes with higher probability.

Latter have better probability of mediocre outcomes, thus safer. But outcomes are insignificant in larger scheme of things. Eg. If you make money that let’s you buy a bigger car or bigger villa or retire early – it’s not generational outcome, it’s some more money. With limited impact on lifestyle & personal fulfillment. Worth it?

Former has generational impact – 10x better products, impact on society – Generational wealth like 1050x kind of return that Bikhchandani created. Choices are personal. But if you are happy about non maximal outcomes, this post is not for you

This post is about 1000x return, so it targets maximal outcomes, Generational impact, Category Creators, High Agency Go-Getters.

Secret 1 -“My car bigger than yours, This can’t define my success” – says Bikhchandani

Exponential returns need goals larger than just money. May be Mission, Purpose, Impact, addiction to solve harder problems or Discover your best version

This is contradicting when we are talking about decoding 1050x returns. But on other hand – we say don’t make money the central point.

But generational outcomes first needs larger goal. Money is a distraction to take small little several actions which lead to great products, impact, value for customers & investors which then makes wealth. Money or wealth is far fetched by product – it can’t be the central theme for generational outcome.

Secret 2 – Define Deeptech very clearly.

Sir Bikhchandani’s fundamental secret – Define Deeptech. His Definition below

“When you create a company out of stuff that’s coming out of a laboratory, it is loosely called Deep Tech… if you need a PhD to understand it, it’s Deep Tech.”

While Sir Bikhchandani may be following even bigger outcomes. Even below will be enough to try for generational outcomes. A feat possible to only outlier founders & VCs.

Alternative – Focus on Applied AI R&D, Product Innovation

Deepseek & Applied AI R&D needs fraction of resources. There’s whole spectrum available

It doesn’t need PhD to understand it. It rather takes a Business & Technologist to build. Having worked in continent scale systems, I can vouch – there’s more than enough talent available in this tier in India. I have access to 2500+ professionals through AI community. A team of 6-12 people can build world class systems.

I further narrow down how this is possible by combining Small Models, much less budgets than OpenAI.

Applied R&D, Product innovation drastically reduces the resources & timeline needed

Vaayu has worked with Deepseek like approach since 2023 – Applied AI, R&D, product Innovation

A clue from China – as supporting argument

Contrary to common belief – China focused on Applied R&D alongside building education infra. Deepseek, Manus AI are results of this. Indian VCs & Founders, IT professionals can build such systems. It’s not only retrospectively, but ahead of curve. Like Future Deepseeks of India.

Let’s look at China’s journey from 1970–2010, which mirrors India’s current stage (2000–2025). In 1980, China’s R&D spending was just 0.6% of GDP, similar to India’s 0.8% in 2000. By 2010, China’s R&D grew to 1.7% of GDP ($95 billion), focusing on applied R&D in telecom and electronics (e.g., Huawei).

Let’s go to secret 3.

I agree that deeptech often starts in labs, requiring complex expertise—but applied R&D can bridge the gap from laboratory to market, making it accessible and commercially viable within shorter timelines. Instead of focusing solely on foundational breakthroughs that demand PhDs, we can use applied R&D to develop practical AI solutions for industries like agriculture, healthcare, and logistics. For instance, China’s DeepSeek leveraged applied R&D to launch the DeepSeek R1 reasoning model in 2025, achieving global fame within two years by outranking ChatGPT on Apple’s App Store (web ID: 1). Similarly, in the US, Mira Murati’s start works on same for Multi modality, Adept developed AI Reasoning models & tools for enterprise automation by 2022, raising $350 million in Series B within three years, proving market fit within a VC-friendly timeline. Major firms like UBS, Citi Bank, JPMorgan, and Bloomberg have adopted these solutions, showcasing their commercial success.

Secret 3 – Bikhchandani looked for Category creator in Zomato

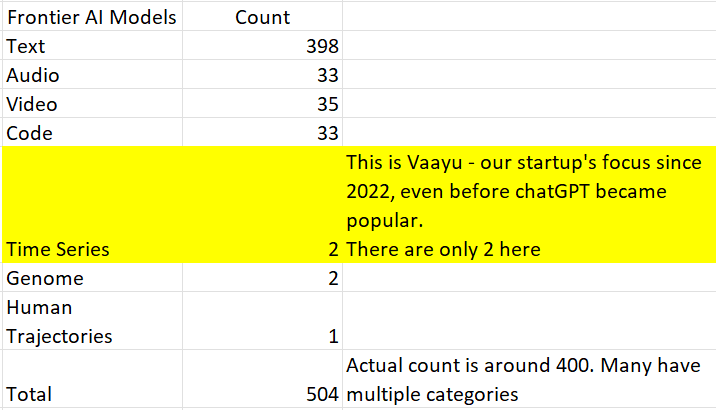

Alternative – Focus on Category Creators – there are only 400 odd out of 1.5m total AI models worldwide

How to spot Category Creators in AI?

I list how frontier models can be spotted. Do you spot – there are already emerging models

Secret 4 – Align with capital availability – Alternative to $12B by Open AI to start with $10M

It just took $191m to build GPT O1 model.

Contrary to very very large sums needed – Like Deepseek or Perplexity, there are ways to stagger the development. Starting with just $5-$10m. Even in $1M – some parts may be started. If someone is trying 1000x return they should probably enter very early stage at $1M raise.

Let that sink in

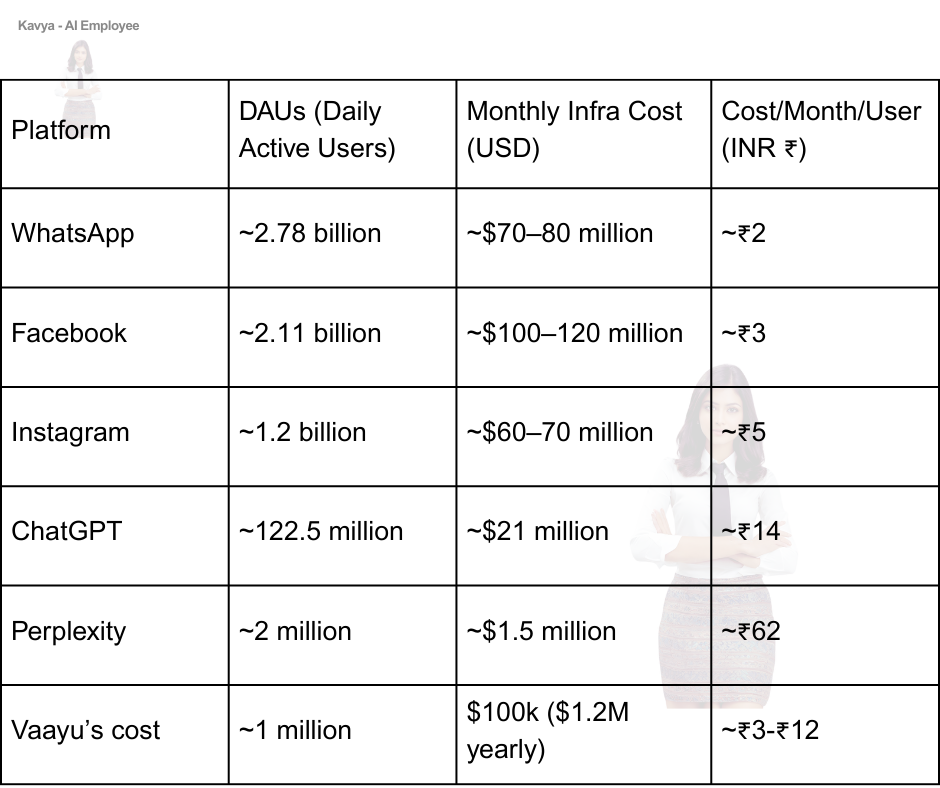

Zepto lost up to Rs 390-700 per order in first year, – total of 390cr chatGPT/Perplexity today lose Rs 10-60 per customer per month. Vaayu has cost at just Rs 3-12 monthly per customer & needs far far less to run similar platform.

I am not against Zepto, it’s their model. All I am saying is – India has capital & risk appetite. We just need collective will to build long term vision & execute for bigger returns in Deeptech & AI. Mind you – costs to run such AI platform will become Rs 1-3 per customer monthly

Cost of Population scale major platforms vs Vaayu

Mind you – the cost of tech & AI will go down. Zeptos not as much. Vaayu has roadmap to bring it down to under Rs 1 per month per customer

This is backed by various technical & business specific optimizations, economy of scale & frugal innovation. So a scoped target market with state of art model will take just $1.2M to start. Vaayu has already done a lots of work on prdouct, innovation & Applied AI & R&D.

4. Secret 5: Align with VCs time horizon, prepare for tech to evolve

Bikhchandani’s Secret: “VCs have bounded time horizon to align with 10 yr period of fund”.

Point well taken. Applied AI, R&D, Product innovation takes 2-5 years to monetize. Steps that I listed above provide agility with evolving market. Founders & VCs can try to

Here are others who are using Applied AI, R&D – Salesforce, SAP, Perplexity, UBS, JP Morgan, Bosch, Mercedes, Oracle, Bloomberg

All of above use Applied R&D with limited horizon. The only thing one has to decide is:

Are you building a water raft for generational outcomes or a pedal boat for mediocre outcomes?

Conclusion:

All of us need to be clear – whether we wish Generational outcomes like Sir Bikhchandani’s or even 20% of that or we are eying mediocre outcomes. For ace Founders & VCs – a non generational outcome is insignificant or as good as failure.

Choice we make defines & takes us to completely different journeys which have different risk profile, resilience needs. But hence different outcomes.

With Applied AI, R&D & Product innovation – there are practical ways to build generational outcomes. Despite the constraints Indian Founders, VCs have. That’s the only path to humongous returns.

That said, the timeless fundamentals by Sir Bikhchandani’s remain same. These are geared by purpose, drive, mission. “My car bigger than Yours, this can’t define our success”. Generational impact, products, innovations do.

With hope and determination,

Atul

AI can do a lot more. Reach out if you are interested

Visit our website Vaayushop to know about AI Employees

Follow us on Linkedin

Follow CEO, Vaayayushop -Atul on Twitter

Follow CTO, Achal on linkedin