AI Contact Center is getting to be a favorite area for getting better Top & Bottom line for Banks. But what are the nuances to make it successful, take go ahead from Board & how this is a ladder for growth of C-suite.

Deepak Sharma & Gokul Rajaram are probably the best people who can put clarity, brevity & simplicity on most complex topics on AI. Both of them have stellar credentials. So when Both picked AI Contact Center as top choice for AI use cases at enterprises & BFSI, we were all ears.

Deepak is founder of Venture Studios, Ex-President & Chief Digital Officer at Kotak Mahindra Bank, a renowned face in Banking. We seek mentorship from him on banking products.

So is Gokul – as much that founding partner at Marathon Management Partners, a venture capital firm. He’s been exec & board member at companies such as Pintrest, Google, Facebook, Coinbase & more. He’s advisor to Vaayu.

What’s Beyond Obvious AI Playbook for AI Contact Center & Why it matters

To generate wealth & progress – It’s obvious that what everyone can do, that will get super commoditized faster than ever with tech.

So it has to be Beyond obvious things which give C-suite an edge. Whether this is promotion or wealth or impact somoene wants to create. A differentiated ladder for growth.

Only 0.1% employees at a listed company make Key Management, earn > 1cr & only 0.03% typically make top earners.

Or just 10 in 10000 employees at a firm crossed 1cr annual income. How to be that 1?

This is based on filing of recent IPO bound companies such as Lenskart, boAt & Meesho.

AI Contact Center is one of ladders to reach towards top. But how? We cover in the post.

Only few C-Suite will reach the top of pyramid. AI contact Center is one of ladders towards top.

So forget about AI Use cases. That’s the job the AI Vendors like us to give you that or workflow which are easily customizable.

Creating C-suite’s own moat with AI Contact Center

So, I don’t cover – generic chatGPT given aspects or Big-4 reports.

Below are beyond obvious things from real conversations based my talks with Deepak, Gokul, filing RFP for a major bank & talks with 10s of other potential customers from C-Suite of banks

Why AI Contact Center?

Deepak puts clarity in a way -few in industry can. This matters not only from Enterprise point of view, but the personal progress of the C-suite, mid managers & everyone? Why?

Deepak’s one liner gives clarity at its best especially for Banking CIOs, Boards & Vendors.

“Enterprises must pick their high-value pockets: in banking, that’s contact centers and credit risk.”

Deepak Sharma – Founder of Venture Studios, Ex-President & Chief Digital Officer at Kotak Mahindra Bank, and Independent Director at Suryoday Bank & Experian India.

Deepak’s statement abstracts the complexity, of course which the teams have to figure out. But That’s your moat to build. Startaing in right direction is the key.

When I spoke to Deepak about some advise regarding opportunity at a Bank for AI contact center that Vaayu was applying – He was crisp & clear on his advise.

AI Contact Center – Growth Ladder for C-suite

I cover – Beyond Obvious C-suite Playbook, challenges in taking AI Contact Centers from board rooms to the real implementation.

I cover below points leading real Actions beyond obvious:

- Why C-Suite Beyond Obvious Playbook & AI Contact Center matters for Growth of individuals & for Enterprise?

- What are things C-Suite should understand beyond obvious? Leave things like Use cases, Workflows to Vendors & Implementors. Create your own moat much beyond that.

- How to impress Board?

- How C-Suite takes control of Topline & Bottomline with AI Contact Center?

- Why a Stellar team matters from Day 1 on comounding long race. It’s not the count. It’s the few with Growth mindset.

Takeaway 1 – Beyond Obvious C-suite Playbook – Dig deep on high-Value Pockets

This question has nothing to do with technology first.

This is more about Unit economics in Bank’s functions.

Which are high value pockets for your bank? Is it Loan, LAP, Credit Card or What?

Which segment makes most money, what’s the acquistion cost. How much your call center spends, After Service etc etc?

Which pockets & functions banks may like to spend, why & how much & where’s the ROI.

Impressing the Board

Gokul – is point blank – in his ask.

Measure value as revenue up, cost down, or 10× efficiency—everything else is noise

Gokul is founding partner at Marathon Management Partners, a venture capital firm. He’s been exec & board member at companies such as Pintrest, Google, Facebook, Coinbase & more. He’s advisor to Vaayu.

Every time I get to interact with Gokul – he can give simple answer to most chaotic situations on product, positioning, ROI or pricing.

May be – this simplicity comes from being on board, his access to best of CEOs, startups & network.

Takeaway 2 – Beyond Obvious C-suite Playbook – Financial projections for AI Contact Center

So building on Playbook Takeaway 1 before, C-Suite must just focus on Topline & Bottomline.

Many professonal just stop & surface level – like vadating vendors for their logos, use cases, who else is using, pricing from varous vendors. That’s Vendor selection ciriteria.

To reach the top of pyramid, C-suite’s individual moat is more of strategic view

Prepare to customized plan on AI Contact center that directly ties with Topline & Bottomline

A very customied plan presented to board that directly ties with Topline & Bottomline of enterprise. There’s noone in market who can understand the minute nuances better than C-suite himself. Since this needs minute & deep understanding of the business which is moat of C-suite.

That’s your ladder for Growth & Moat

For Banks Revenue Up meant these things, in my talks to C-suite

Clarity on Capex vs Opex Curve

In recent RFP of major bank we filed, it had 3 headings

- One time setup fee – Includes AI training fee, On premesis deployment

- Customization & Integeration fee – Integerate with the workflows of bank

- Subscription fee

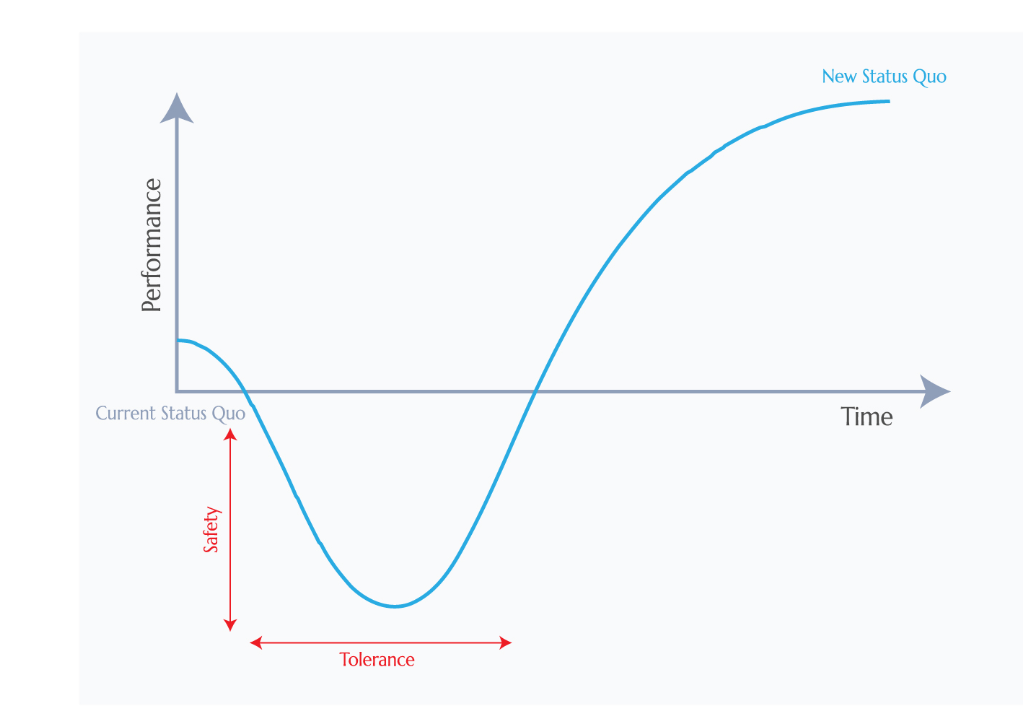

As C-suite – this adds complexity not generally understood by less senor staff. This is going to follow J-Curve.

Takeaway 3 – Beyond Obvious C-suite Playbook – Prepare for dip – J curve, it’s okay to get to new heights

Your cash flows my look negative, pilots may fail in short term. Embrace all of that. That’s where the role & opportunity to show leadership is. That’s the ladder to growth. That’s for good (Ref img J curve by Getnave)

Takeaway 4 – Beyond Obvious C-suite Playbook – Build Stellar teams

I must apologise. But I have heard this – “We have a team of 400 IT, They are building AI”.

I have no doubt about the capabilities of large sized teams. But AI is different beast

My experience doing continent scale migratioin to new tech system says – It doesn’t matter how many people you have working on systems which are already set.

AI is so new that it needs 2-3 years of priming up to understand the context.

Bell Curve – Only 3-5% people in your team & partners are up for growth at any time

From my talks to multiple Vendors – Banks have run 10s of pilots, but 90%+ haven’t seen light of day.

Journey will need a supportive & equaliy growth hungry team

Only 3-5% can help you sail that trough.

When things change fast, there aren’t 100% clear instructions – that’s when a leader shines. But he needs a supportive team.

This team isn’t just skilled. They are stellar, growth hungry. They are go-getters.

Pilots don’t scale in lack of long term view

Deepak, was brutally honest about AI & role of C-suite – “You may be do 10s of pilots, but unless the leadership puts a strategic view – it won’t move beyond pilots”

I can vouch with our experience filing RFP for a major bank & my experience at enterprises – Problem isn’t with tech. It’s because – AI isn’t only about Tech. This is about ROI, Change management, Cash flows, taking buy-in from board, talent & many more things.

But that’s where the opportunity to build moat for C-suite lies.

Where AI Contact Center may lead a C-Suite to

There are only few equipped to sail this sort of uncertainty. If you don’t trust me – In India there are only true 5000 global leaders in GCCs & only 8000 odd people who can be of CEO of BSE 500 companies.

To get to top of Salary Pyramid – C-suites have to prove their mettle. AI Contact Center is that ladder to top of pyramid.

👉 Read more blogs for use cases of AI at our blog

👉 Read AGI for Finance – Catch the next wave for your growth