Do-Or-Die for finance firms. AI for Finance in 2025 promises to be a savior. World prepare for volatility with essential AI strategies for survival & to capture opportuAI for Finance in 2025 can transform firms. Prepare for volatility with essential AI strategies for survival.ities

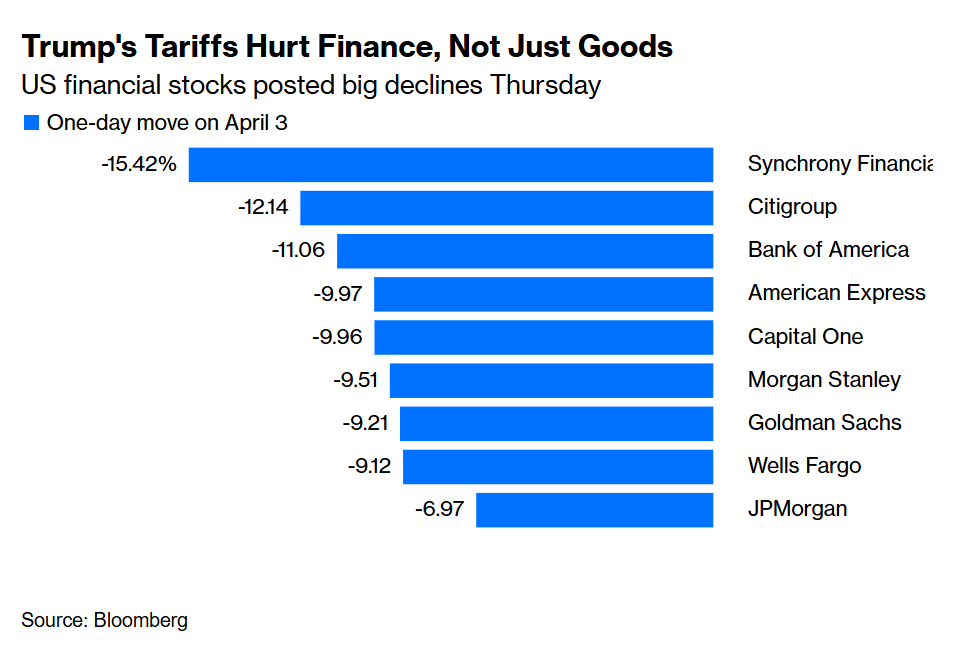

Trump & AI will ensure there’s no dull day for Finance in this decade. Consumer Finance, SME lending, Small finance firms hit worst. SMEs, lower-income workers and families get impact first and most, so consumer finance companies, financiers serving to these segment & their shares were hit hard. There are likely to be cycles of volatility for entire decade.

Thus this volatility is Do-or Die for mid to small-medium financial firms.

I cover how financial firms can prepare for these volatility cycle in most frugal budgets with AI Agents. Firms which are prepared to survive these volatility cycles – gain big during highs & survive during lows.

AI for Finance in 2025, larger trend – A C-suite perspective.

A role of C-suite executive not only to ensure operations & putting out fires weekly. It’s also to prepare for upcoming trends – capture opportunities & survive threats.

Let’s see overall trend. First see the signs of what happened & how it impacts you.

Trump Tariff is part of larger financial cycle

Ray Dalio says- The monetary/economic order is breaking down. on debt to finance their excesses (e.g., the United States) and b) lender-creditors (like China) who already hold too much of the debt and are hooked on selling their goods.

We are seeing a classic breakdown of the major monetary, political, and geopolitical orders. They have happened many times in history when similar unsustainable conditions were in place.

Add to it the volatility with AI. Though we are once in lifetime abundance & wealth creation phase promised by AI & economic structures – but the volatility, highs & lows of market & conditions is the norm for decades to come.

Mid-Small Financial firms hit hardest

Banking across verticals was hit – Credit card lending, money management and investment banking. However – why worst hit is SME Lending, lenders to mid-markets, Consumer finance? Reason is AI, change in job markets & inflationary pressure will hit & non-performing assets will likely rise. This is evident from US stocks in segment hit hardest. Back in India – small cap & mid cap 10.50% & 8.15% respectively on 8th April.

This trend of volatility is likely be there for full decade as AI makes strides, 54% of jobs are in purview of big impact. Add to it the impact on Indian service industry – white collared jobs. But there are going to be highs also as AI brings productivity & profits.

How Financial firms are preparing with AI in 2025?

I have often heard mid-managers getting bewildered by AI or say they don’t see use case or ROI as yet. But if you are are in strategic role or soon going to elevate to that role – you would know writing on wall.

Building past or operating a settled system is one thing, building future needs strategic thinking & lot more energy.

It’s no wonder that it’s typical C-suite or top 3-10% of organization who are on distinctive career trajectory are leading AI initiatives.

I cover how other banks have done it & what it takes small financial firms, nbfcs C-suite to prepare with their vision & leadership in frugal budgets.

Real world use cases of AI with business impact for financial firms

Below are impacts already achieved. Mind you – this is the basic foundation – once your firm has it, you may accelerate 10x than your competitors.

- Wells Fargo: GenAI Banker Assistant did 245.4 million interactions. AI loan approvals slashed processing times by 40%, saving an estimated $200 million yearly (link).

- Klarna – A Swedish Buy now, Pay Later Fintech: AI = 700-900 staff. Handled 90% of customer queries, 35 languages and operates across 23 markets, saving $40 million annually. Vaayu’s product AI Kavya works with 7 languages.

- Bajaj Finance: GenAI use cases across 25 work streams to save $20m in FY26 alone

- Paytm: AI micro-loan systems approved 10 million loans monthly, halving costs. (link)

- UBS: has AI M&A expert that can scan 300,000 firms data in 20 seconds. Vaayu’s AI Disha/Tori can build M&A reports in matter of minutes that took 3-4 weeks & M&A expert of $30-$50k salary.

- HDFC Bank: AI resolved 85% of inquiries, saving an estimated $30 million in 2024.

- Razorpay: AI fraud detection blocked an estimated $5 million in threats in 2024. (link)

- Standard Chartered: AI wealth advisory tools boosted AUM by an estimated $500 million in 2024. (link)

Quiz – who of these will survive lows & capture highs of market?

Trump’s trade war are a bigger economic cycle. US debt & Chinese export to US – create perfect situations when geo-political changes are done. AI adds catalyst to volatility. Both these will last over a decade.

This is a sign of how things will be starting now & may last several years for over a decade. The savior for this volatility is the one which is built for agility. Financial firms put in $15B last year in AI.

Practical problems that mars financial firms.

As I said, this needs strategic leader. Those who can see the future & prepare their firms. First mistake that mid firms do is to ignore the obvious& treat it as operational stuff. Like purchasing a traditional software. Or ignoring till it becomes a threat. It’s like remaining unguarded until the situation arises.

Unlike bespoke AI for giants, Kavya’s plug-and-play platform empowers NBFCs for loans, advisory, or M&A. Kavya starts small—handling client queries—then scales to transform entire operations, from fraud detection to M&A analytics. India can build these tools for global markets, but delay risks disruption.

Second common mistake is trying to be over obsessive about immediate ROI & case studies. Realize that it’s the foundation that you lay. You may building once the foundation is set. But it’s going to take some energy at beginning. But remember – you are preparing for massive growth & volatility proof firm to prepare for decades to come

Third mistake is to either build everything on their own, trivializing the development & cost. For long vision it needs skilled partner or teams. Or firms keep waiting until someone else builds.

Mind you, building AI for getting volatility proof is a strategy by C-suite, it’s neither a software purchase nor a mere trivial tech development.

How to start with AI in frugal budgets?

Solution is to take the base solution. This is what even JP Morgan did. They started small for 1 year. You may start with Kavya within 7 days with base solution. Catch up with bigger firms & start preparing to outcompete competitors.

Small Financial firms, nbfcs or even banks can start with AI Kavya as base solution. This gets you started in very very small budgets. Then work your way to high cost pockets or to capture the market aggressively as your business demands.

Building ROI & volatility proof firms with AI is a journey. It’s not mere operational role.

Conclusion & Action

US debt & rise of China has led to situation which historically has led to short but sharp cycles of volatility. Moreover AI is going to cause unseen disruptions in market. Small-Mid financial firms, Consumer finance, SME Lending firms are likely to be hit more than the average.

The AI banking race is on. Set your vision to capture highs of market or survive lows. Start with Kavya as an AI relationship manager to personalize client experiences, then build game-changers like AI M&A or fraud detection. Got C-suite banking contacts? Connect them with Vaayu. Giants spend billions, but smaller firms can soar with Kavya. Don’t miss the multiplier effect—partner with Vaayu now or watch rivals dominate.

The emphasis on volatility as a permanent feature of this decade really hits home. It’s interesting how AI isn’t just a growth tool but a survival mechanism for smaller firms now.